Introduction

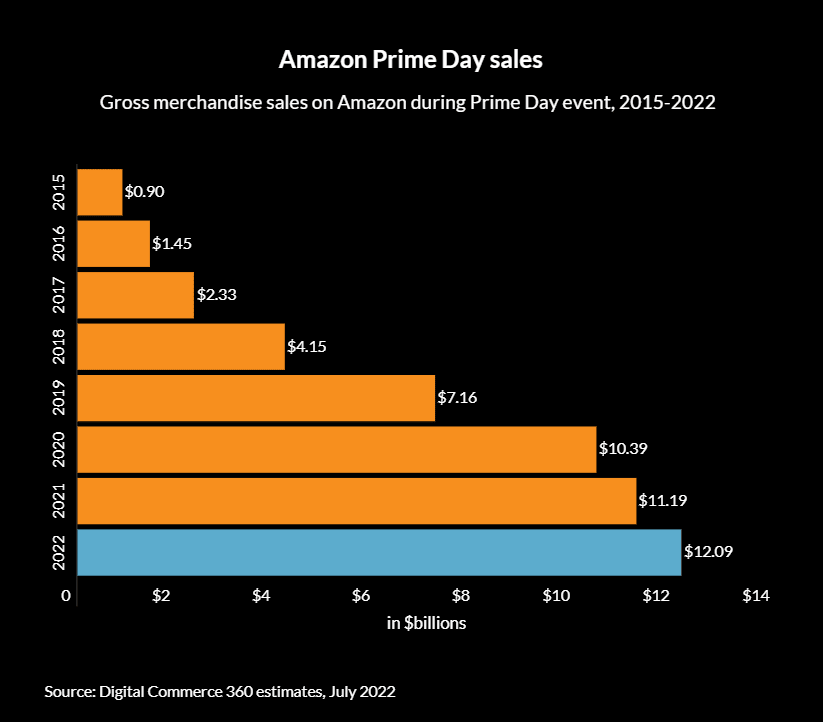

It was yet another year of blockbuster sales for the just concluded Amazon Prime Day. The Prime Day this year was held on the 12th and 13th of July across 20 markets of Amazon. In contrast, the event was bumped to October during the first year of the pandemic and then to June last year. This year’s event kept in line with the usual times and was a welcome return to form. Consumers worldwide spent more than $12 billion over the two days. Even though the sales growth was modest, it was still a slight uptick over last year’s growth. The 2021 Prime Day sales stood at $11.19 Billion, so that’s an 8.1% jump over the previous year. For a third time in a row, the marketplace sales grew faster than the sales of Amazon’s own products. You can refer to the last years stats for the Prime Day in our blog.

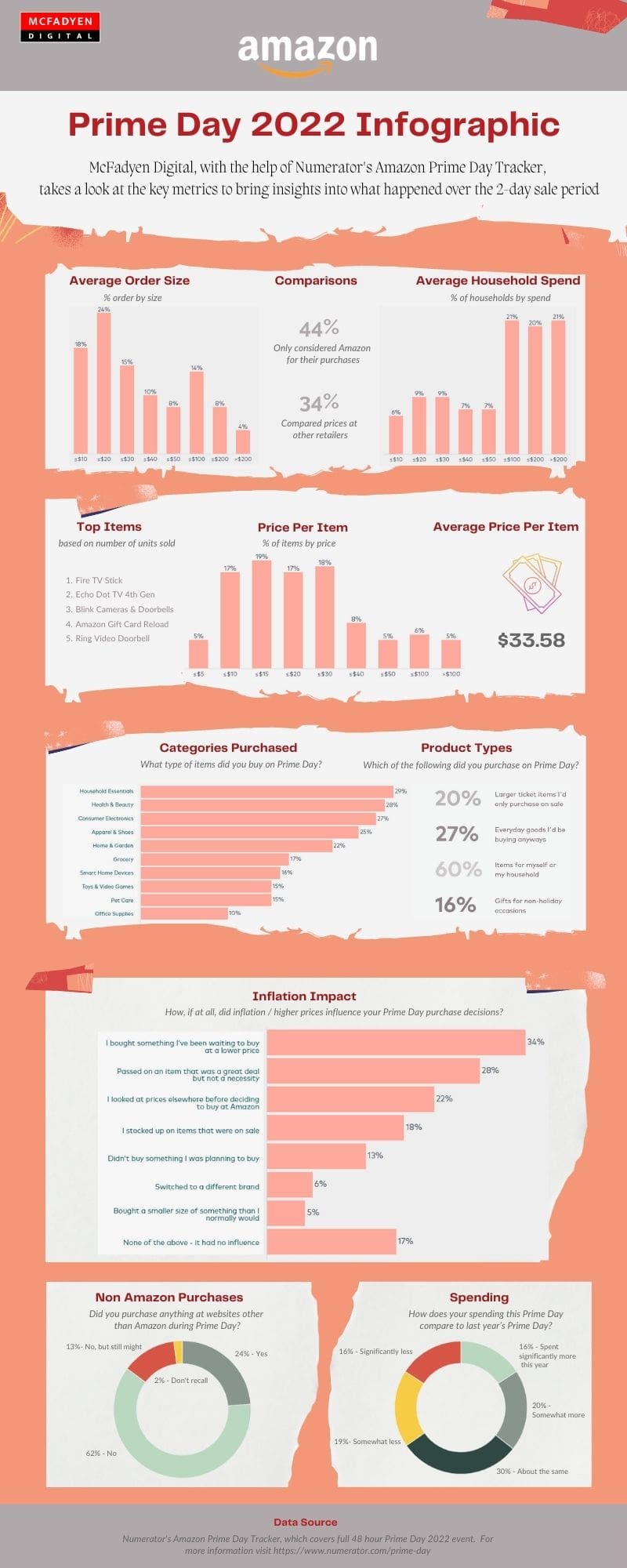

We have built an insightful infographic with the help of data from Numerator. Numerator’s Amazon Prime Day Tracker compiles a live look across Numerator data sources to bring immediate insights into what is happening on Prime Day.

Amazon Prime Day is now into its 8th edition and was launched in the year 2015 to mark Amazon’s 20 years in business. Over time, it has evolved into an event aimed at driving subscriptions for Amazon’s customer loyalty program, Amazon Prime, offering the best deals across products and categories. The $14.99 per month Prime membership plan provides its member’s perks like free and video and music streaming, one- or two-day shipping, digital photo storage. Prime Day has grown much more prominent in size and scale, starting as a 24-hr event to now as an entire 2-day event spanning several markets worldwide. Prime Day has now become a global retail event as a slew of retailers hold their own sales to rival Amazon. Target, Best Buy, and plenty of other brands run their own sales around the Prime day.

As per Amazon, this year, they sold more than 300 million items during the sales compared to 250 million last year. There are also unconfirmed reports that suggest there may be another Prime Day deals extravaganza in Q4 later this year. Amazon currently has over 200 million Prime subscribers worldwide. According to the Consumer Intelligence Research Partners, there are 172 million out of the 200 million US consumers.

Now let’s look at the key trends that defined this year’s Prime Day Sales.

#1 Continued Growth of 3rd Party Sellers – Prime Day has been historically associated with Amazon heavily promoting its own products, and these products do make the best sellers each year. But if you look at the bigger picture, you see that 3rd party (marketplace) sales are growing more significantly than Amazon’s 1st party products. For instance, marketplace products grew 11.7% year over year, up from 10.4% during Prime Day 2021. For the last couple of years, Amazon has been investing more to spotlight the marketplace sellers in their deals, especially the small and medium-sized seller businesses. As a result, Amazon’s selling partner growth is outpacing Amazon’s own retail. Third-party merchants’ sales accounted for over 37% of all Prime Day sales through Amazon this year, up from 36 % in 2021 and 35 % in 2020. Leading up to the 2022 Prime Day, Amazon ran the “Support Small Businesses to Win Big” program. As per Amazon, this drove sales of over $3 Billion worth of purchases through marketplace sellers. In this campaign, every $1 shopper spent on eligible “small-business,” or third-party seller, products from June 21 through July 11 gave customers a chance to win prizes like pre-game experience and tickets to Super Bowl LVII, VIP passes to musical shows in Los Angeles and Las Vegas. Amazon also publicized its new “Small Business Badge” to make small businesses stand out.

#2 Use of Social Commerce & Influencers for Promotion – For this edition of Prime Day, Amazon relied heavily on promoting the event through social channels and influencers. This worked at many levels as shoppers were flooded with organic and paid media campaigns on social media that helped them choose the best and most relevant deals. For weeks leading up to Prime Day, Amazon relied on influencers to drive sales from live video shopping. This saw Amazon partnering with celebrities like TikTok creators Joe and Frank Mele, Porsha Williams from “The Real Housewives of Atlanta,” comedian Kevin Hart, and Australian model Miranda Kerr to promote Prime Day. As per reports from Amazon, these partnerships generated over 100 million views for Amazon products. However, there wasn’t any data available to ascertain how much sales these promotions generated. Some reports out in the media suggested that Amazon struggled with live commerce promotion with influencers unable to fetch more than 4000 live viewers.

#3 Even with Inflation Consumer Spend Went Up – A Digital Commerce 360 survey on online shoppers seemed to suggest that at 46%, nearly half of the consumers reported spending more on Prime Day this year as compared to last. In contrast, 37% mentioned spending equal, and 17% said spending less compared to the previous year’s Prime Day. Another report from Adobe Commerce was in line with overall sales over the two days. Adobe gave a figure of more than $6 billion on day one and $5.9 billion on day two sales. Consumers were eager to seek out epic deals and bargains as inflation continued to soar. Due to the inflation concerns and decreased savings, consumer spending this year was more on household and essential goods. Numerator’s panel data showed that more than 27% of the consumers bought everyday stuff they would be buying even otherwise, compared to 20% of consumers who wished to purchase large-ticket items during the sale days.

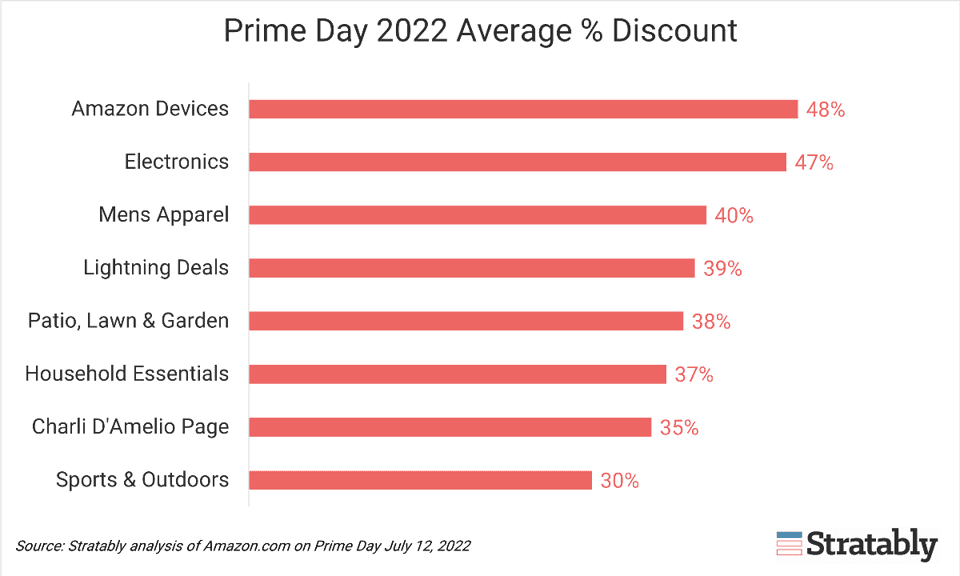

According to Amazon, consumers saved $1.7 billion through deals and discounts on the 300 million items purchased. The biggest selling categories in the US were consumer electronics, household essentials, and home items. What also helped sales gather momentum was the fact that “back to school” season was around the corner. As is usually the case, Amazon’s devices, including Fire TV, Echo, and Blink devices, were the top sellers.

#4 Epic Discounts Across Many Categories – It is widely known that Amazon uses Prime Day as an opportunity to heavily discount and sell Amazon-branded products like Kindle, Fire Stocks, TVs, and other Alexa-enabled devices. It was no different this year, with many Amazon products carrying discounts upwards of 45%. Heavy discounts were not limited to Amazon products; grocery was also one area with discounts of 30% and more. In one of the first of its kind this time, Prime Deals were available outside of Amazon via the “Buy With Prime” program, thanks to Shopify. Over a few dozen Shopify stores enabled the “Buy with Prime” on their site to allow the customers a 20% discount at checkout. According to an analysis by Stratably across categories, it was evident that discount percentages varied greatly. Typically, sales were up by 4 to 5 times compared to a typical day. All the data we have been able to lay our hands on suggest that it is yet another year for Prime Day to have delivered solid results for all the parties involved.

#5 Growth Mostly Driven by Amazon – Even though there were other retailers in the fray to leverage the momentum generated by Prime Day, it was relatively on the lower side as compared to previous years. The data from Numerator’s panel and Adobe Index suggests that most consumers kept shopping on the Prime Days limited to Amazon. While Walmart had run the “Deals for Days” campaign during last year’s Prime Day, it decided to give this year’s event a miss. It instead chose to run a deal event in early June. The biggest selling categories in the US were consumer electronics, household essentials, and home items. Some top-selling items were Apple Watch Series 7; Crest Teeth Whitening and Oral-B electric toothbrushes; Levi’s apparel and accessories; Shark vacuums, air purifiers, and steam mops; Beats by Dre headphones and earbuds; and Lego sets.

Summary

Overall, it was yet another winning year for Prime Day. This year’s edition was fraught with concerns like increasing inflation, economic uncertainties, the Ukraine war, and global supply chain woes. Yet, it beat the estimates by taking home sales of $12 Billion. Although it cannot be disputed, inflation did impact the overall sales, and some retailers didn’t get the traction they hoped to achieve. It was quite a relief to note that Prime Day sales were not flat as many had predicted. What saved the day was the propensity of shoppers to continue purchasing must-have items like personal care products and CPGs at the cost of high-ticket nice-to-have products. It has been a tough year for Amazon, with a sharp fall in its share prices at the time of this writing. Although sales have been decent, there is already talk about another Prime day this year to drive more sales. It’s a great time to be an Amazon customer.

Related Articles

Turn Insight Into Impact.

Start Today.