The retail landscape is undergoing a profound transformation, driven by digitalization, evolving consumer expectations, and the emergence of new business models. Euromonitor International’s report, in conjunction with the National Retail Federation, titled “Retail Reinvention: A Framework for Future Growth,” provides invaluable insights into these changes, highlighting the opportunities and challenges for retailers aiming to thrive in this dynamic environment.

The Report

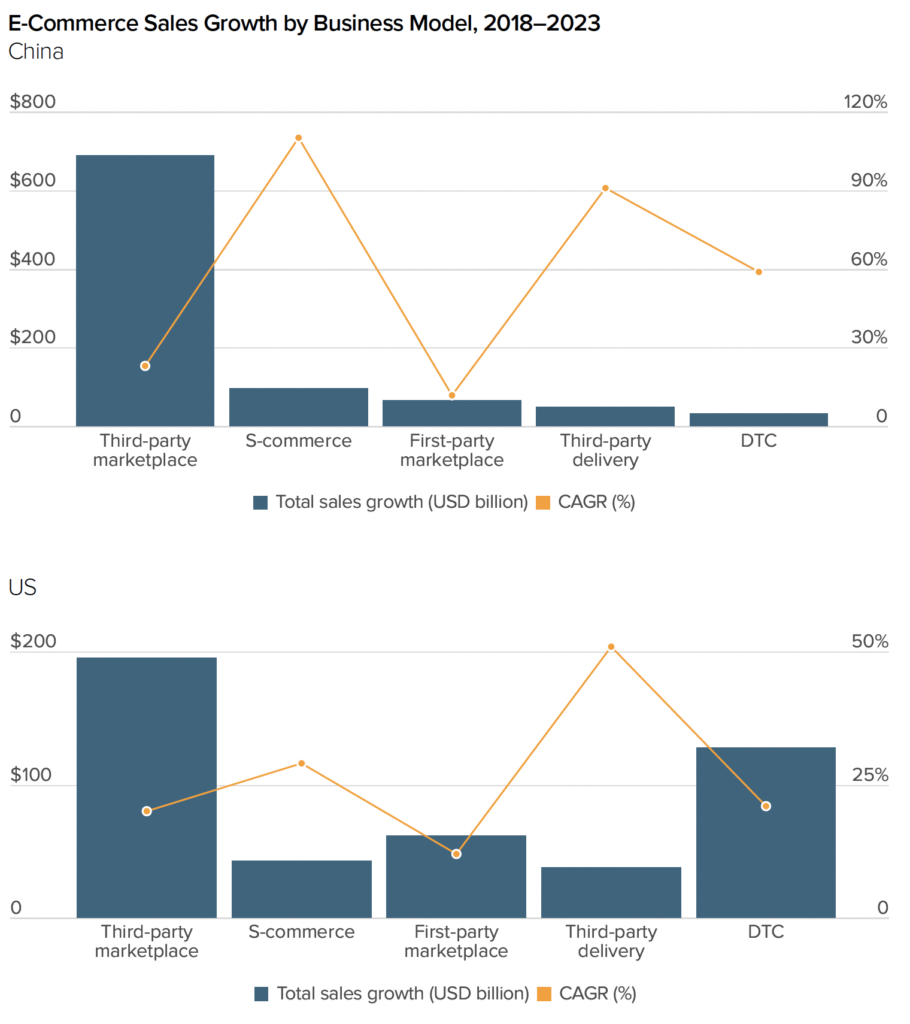

Figure 1 is from the Euromonitor International Report, “Retail Reinvention: A Framework for Future Growth” and demonstrates how third-party marketplace, first-party marketplace, and direct-to-consumer ecommerce channels have outpaced others in the past five years.

Retail, as we know it, is continuously evolving with digital serving as a pace accelerator in that regard. The Euromonitor report emphasizes that the digitalization of retail has fundamentally altered the traditional buying journey, introducing new ways of selling and higher consumer expectations for personalized and engaging experiences. According to the report, ecommerce is set to drive a staggering 56% of global retail sales growth over the next five years. This rapid growth underscores the critical need for retailers to adapt and innovate to stay competitive.

The transformation of retail is not just about shifting to online sales but also about rethinking business models, expanding channels, and meeting the evolving expectations of shoppers. As Michelle Evans, Global Lead for Retail and Digital Consumer Insights at Euromonitor, highlights, “New business models, channels, and shopper expectations continue to change the landscape. These three areas redefine industry rules and relationships—transforming the path to purchase in the process”.

Key Findings

1) Emergence of New Business Models

The retail sector has seen a significant shift towards new business models such as marketplaces, direct-to-consumer (DTC), and social commerce. Marketplaces, in particular, have become highly influential, with third-party marketplace sales expanding by $1.2 trillion from 2018 to 2023, growing ten times faster than the overall retail sector. This growth is driven by the success of platforms like Amazon, Tmall, and Mercado Libre, which have become household names.

2) Direct-to-Consumer (DTC) Growth

The DTC model is gaining traction as both established and emerging brands seek to cultivate direct relationships with consumers. In 2023, more than $205.9 billion in sales came from the DTC channel in the US alone, representing 17% of ecommerce sales. This model allows brands to gather customer insights and boost profits by bypassing traditional retail intermediaries.

3) Influence of Non-Retail Brands

Non-retail brands such as social networks, streaming services, and gaming platforms are increasingly entering the retail space. For instance, ByteDance’s Douyin and TikTok Shop have successfully integrated commerce functionalities, with Douyin becoming the largest online retailer for beauty and personal care products in China by Q1 2024. This trend is expected to grow, with social commerce sales in China and the US projected to more than double by 2028.

4) Diversified Revenue Streams

Retailers are exploring alternative revenue streams beyond traditional merchandise sales. Value-added services, retail media networks, and ecosystems are some of the avenues being pursued. For example, nearly two-thirds of brand manufacturers have allocated investments towards retail media networks, recognizing the opportunity to better target consumers and drive incremental sales.

5) Channel Expansion and Omnichannel Integration

Retailers are moving towards omnichannel business models, aiming to create a unified shopping experience across various touchpoints such as brick-and-mortar stores, ecommerce websites, mobile apps, and social media platforms. However, integrating these channels remains a challenge due to budget constraints and system integration issues. Nonetheless, the reward for overcoming these challenges is significant, as omnichannel shoppers tend to spend more and visit stores more frequently.

6) Personalization and Consumer Expectations

Consumers increasingly expect personalized shopping experiences. According to Euromonitor, half of the consumers want tailored products or services, and one in five seeks personalized shopping experiences. Advanced technologies like AI and AR are crucial in delivering these customized experiences, although they require significant amounts of shopper data.

7) Sustainability and Values-Based Buying

Consumer values are playing a more significant role in purchase decisions. Approximately 30% of consumers prefer to buy from brands that support social and political issues aligned with their values, and 25% are willing to boycott brands that do not share their beliefs. Retailers must balance the demand for sustainability and ethical practices with their business objectives.

Conclusion

The Euromonitor report emphasizes the need for retailers to continuously innovate and adapt to the rapidly changing retail environment. The growth of ecommerce, the emergence of new business models, and the evolving expectations of consumers present both opportunities and challenges. Retailers must embrace digital transformation, diversify their revenue streams into parallel channels, and invest in personalized and sustainable solutions to stay competitive.

Looking forward, the retail industry is poised for continued growth. A recent statistic projects that global retail ecommerce sales will reach $6.4 trillion by the end of 2024, underscoring the vast potential for retailers who successfully navigate this transformation.

For retailers seeking to capitalize on these trends and drive future growth, McFadyen Digital offers unparalleled expertise in ecommerce and marketplace solutions. Contact us at info@mcfadyen.com to learn more.

Related Articles

Turn Insight Into Impact.

Start Today.