The following article is based on the recently released Marketplace Monetization: How to Make Money as a Multi-Vendor Ecommerce Operator book by Tom McFadyen and other SME contributors, which has recently reached #1 status in three Amazon categories. The book is available for purchase in Paperback Print and Kindle Edition formats. An on-demand webinar on the topic featuring the CEOs of Mirakl, Balance, and McFadyen Digital is also available for viewing.

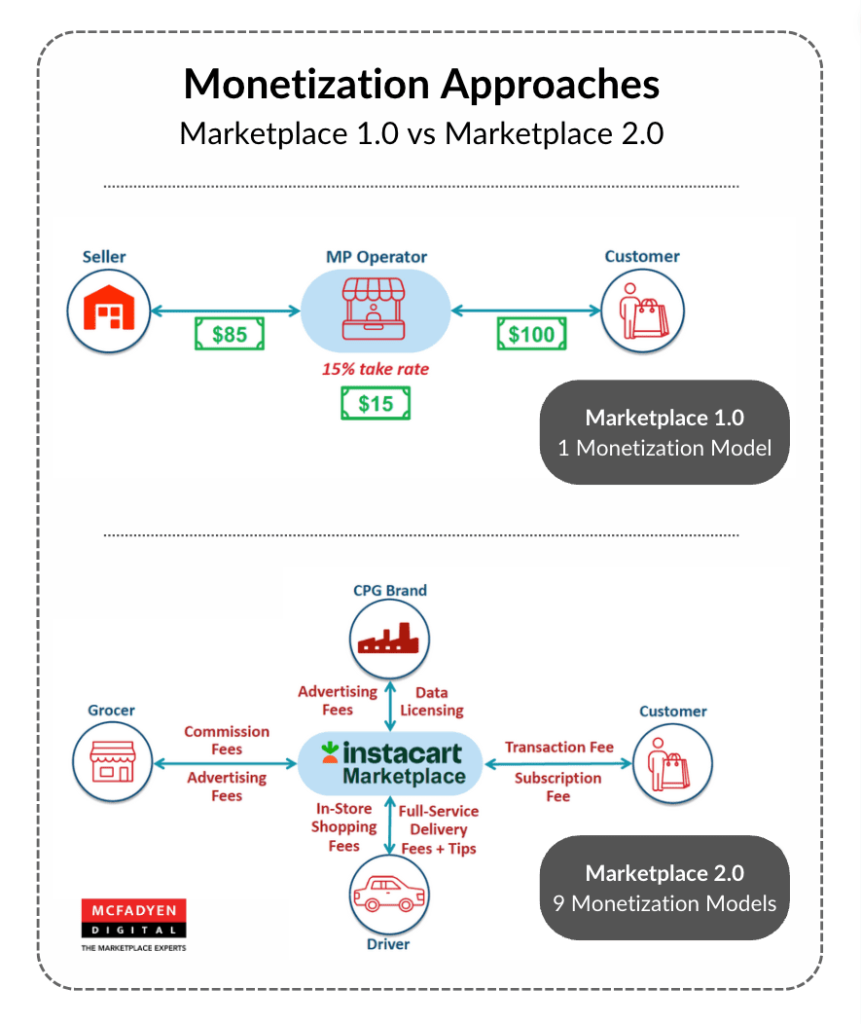

The exploding popularity of the online marketplace model has brought new and exciting ecommerce growth possibilities to organizations all around the world utilizing an expanding variety of multi-vendor commerce permutations. Yet for all the scale and success marketplaces have seen, many have either failed or underperformed due to insufficient monetization strategies. Fortunately, this is a solvable issue that presents opportunities for previously unseen levels of sustained profit. Capitalizing means being aware of the monetization possibilities and implementing such measures in a way that adds value to the sellers and customers as your bottom line increases. And thus we get into the concept of “Marketplace 1.0” where stock expansion and commision monetization were the primary drivers evolving into the increasing business model sophistication and parallel monetization channels of “Marketplace 2.0”.

To frame the Marketplace 2.0 monetization opportunity, let’s take a look at a more traditional retail example of parallel monetization, the shopping mall. A shopping mall operator primarily makes money by charging their tenets rent, but that’s hardly the only source of profit for that operator. They also sell print and video advertising space in various forms throughout the mall. There are areas for featured product displays which are rented weekly or monthly to the retailers. The food court provides a valuable consumer service, but is another source of either rent or margin for the operator. Some even have arcades or other entertainment options run by the mall operator, all which provide additional shopping experience value and profit. Just like that mall operator is creating multi-sided revenue extensions beyond the core profit driver of rent, online marketplace operators have many channels from which to drive additional profit beyond the core of commision or transaction fees.

Need someone to help you think through a implementing a marketplace? Learn more about our B2B marketplace development services.

Marketplace 2.0 means a Fully Monetized Marketplace

The Marketplace 1.0 model typically monetized commision fees or seller subscription fees and little else. Marketplace 2.0 monetizes every channel possible while adding value to all sides.

Marketplace 1.0 is what popularized the model, seeing the first round giants such as Amazon, Alibaba, Walmart, Teleflora, Ebay, and more blaze the path towards a multi-vendor ecommerce future. This 1.0 model focused primarily on marketplace as a category expansion and inventory depth mechanism with most revenue being driven either by commision fees (Amazon, Walmart), transaction fees (Ebay), or seller listing fees (Alibaba). And while enough sellers providing goods to enough buyers can certainly be profitable, there were valuable lessons to be learned as more and more retail and B2B ecommerce organizations launched marketplaces.

Marketplace 2.0 goes far beyond the category and depth purpose of a marketplace with additional models such as vertical marketplaces (narrow focus, but deep stock), closed marketplaces (loyalty programs), circular platforms (recycle/upcycle, reuse), group purchase organizations, eprocurement, and hybrid dropship/marketplace experiencing success in a number of industries. Each of these models has one thing in common, other than the multi-sided nature of their commerce model, and that is the possibility to monetize each of those sides.

There are several ways to monetize a marketplace, but the biggest profit-motive methods are commissions & subscriptions, embedded financial services, retail media/on-site advertising, and internationalization/cross-border considerations. From there, you can layer in additional seller services related to data, logistics, or storefronts, claw-back funds via seller penalties, or adding additional consumer services, just to name a few. The goal is always the same, to add value to the seller and buyer experience while charging additional fees that pad the bottom line beyond the core profit divers.

Commissions & Subscriptions

Commissions are the most common way to monetize a marketplace. This is where the marketplace operator takes a percentage of each transaction conducted on the marketplace. In lieu of a commission, a flat fee can be levied per transaction, but the percentage of sale model is far more common. This vital revenue stream has evolved from its nascent stages, seen with early digital marketplaces like the Boston Computer Exchange, to sophisticated structures utilized by giants such as Instacart, Amazon, and Walmart.

An alternative method is the seller subscription model where the sellers pay a yearly or monthly fee to list on the marketplace instead of charging a fee per transaction. This is often enacted when a marketplace operator fears revenue leakage where sellers are incented to take relationships offline due to commission fees.

Embedded Financial Services

As marketplace operators look to expand their earning avenues, embedding financial services emerges as an innovative proposition. Particularly, the Buy Now Pay Later model (BNPL) is rapidly growing. Projected to reach a market size of $309.2 billion in 2023, BNPL solutions like AfterPay bridge the gap between immediate purchase desires and payment flexibility. By automating transactions and payment terms, marketplaces see this as a golden opportunity to accelerate their growth cycle. The adoption of embedded financial services also paves the way for marketplaces to offer tailored financial products, such as buy-now-pay-later options, personalized loans, and flexible payment solutions. This not only facilitates increased affordability and access for consumers but also opens up new revenue streams for the platforms.

On the B2B side of things, we’re seeing examples of this with innovative offers from companies like Balance, who provide a simplified checkout experience, but also allow operators to offer terms to their buyers for larger purchases (basically, business BNPL), with the option of adding additional percentage values to the terms as another profit center. Both the consumer-like checkout process and the presence of such expanded payment options benefit all sides of a marketplace with the added profits resulting in happier customers and sellers.

On-Site Advertising / Retail Media

On-site advertising and retail media have emerged as powerful tools for marketplaces to monetize their platforms while providing brands with a direct channel to engage with potential customers. The precision and effectiveness of on-site ads in driving conversions cannot be overstated; a strategy that capitalizes on real-time data to display relevant advertisements to consumers at the pinnacle of their purchase decision. In recent years, retail media spending in the US has witnessed a robust growth, with forecasts suggesting it will continue to ascend as brands recognize the value of advertising in a marketplace setting.

Further enhancing the value proposition of on-site advertising is the shift towards creating immersive, content-rich advertising experiences that inform and engage consumers. By integrating native advertising, sponsored product listings, and branded content, marketplaces offer a less intrusive and more organic ad experience. This approach not only enriches the shopper’s journey but also maximizes the impact of ads, driving higher engagement rates and return on investment for advertisers. In an increasingly competitive digital landscape, the ability to capture and retain consumer attention through effective retail media strategies is critical.

This immersive and embedded experience has seen marketplace platform operator Mirakl go to the lengths of creating their own retail media offering called Mirakl Ads. The interesting part about this offering is that it’s built specifically for online marketplaces in that it can handle an operator’s third-party marketplace, dropship and first-party ecommerce assortment with the ability to factor in marketplace model specific factors such as a multi-seller cart, their related stock levels, and any ‘”buy box” considerations. It’s a prime example of where the multi-vendor models of ecommerce are heading when it comes to extending the monetization possibilities.

Cross-Border / Internationalization

Cross-border ecommerce presents a golden opportunity for marketplaces to extend their reach beyond local boundaries, tapping into a global customer base eager for diverse product offerings. A Forrester study predicts that by 2027, cross-border transactions will constitute 20% of all ecommerce sales, highlighting the growing consumer appetite for international shopping experiences. This trend underscores the importance for marketplaces to adopt strategies that facilitate global commerce, from optimizing logistics to navigating the complexities of international trade laws and regulations.

Localization plays a crucial role in the internationalization of ecommerce platforms. Tailoring the marketplace to accommodate local languages, currencies, payment methods, and cultural preferences significantly enhances user experience and fosters customer loyalty across different regions. Personalization based on regional nuances allows marketplaces to resonate more profoundly with international audiences, driving engagement and sales. Leveraging technology and local market insights, platforms can achieve a seamless global shopping experience that meets the evolving needs of consumers worldwide.

Other Monetization Areas

Beyond their core transactional revenue, marketplaces possess various avenues to diversify their income and enhance the overall platform attractiveness. Fulfillment services, for example, have become a distinguishing feature, turning logistical processes into a competitive advantage and a source of revenue through premium shipping options. Efficient logistics and delivery solutions not only elevate the customer experience but are also integral to meeting the rising expectations for swift and reliable order fulfillment.

Marketplaces are also innovating in creating revenue opportunities through compliance-based mechanisms and premium buyer services. For instance, implementing seller penalties for non-compliance and introducing value-added services like extended warranties, loyalty programs, and subscriptions for exclusive access to deals are strategies that not only generate additional income but also strengthen community bonds and user engagement.

Next Steps

For marketplace operators, monetization is not just a goal—it’s a continuous journey of innovation and adaptation. The importance of financial modeling, technology assessment, and aligning organizational structures cannot be overstated. A thorough revenue roadmap drawn from insightful data and tested models usher forth a future of sustained growth.

If your organization could benefit from the steady hand of experienced marketplace and ecommerce experts, reach out to us at info@mcfadyen.com and we’ll be happy to help. Also remember to check out the Marketplace Monetization book for a lot more in-depth information on how to maximize the monetization strategy for your marketplace.

AUTHOR

Thomas Gaydos

CMO & Author

McFadyen Digital

VISUALS

Tom McFadyen

CEO & Author

McFadyen Digital

Related Articles

Turn Insight Into Impact.

Start Today.