Singles Day 2019 is a $38.4 Billion Home Run

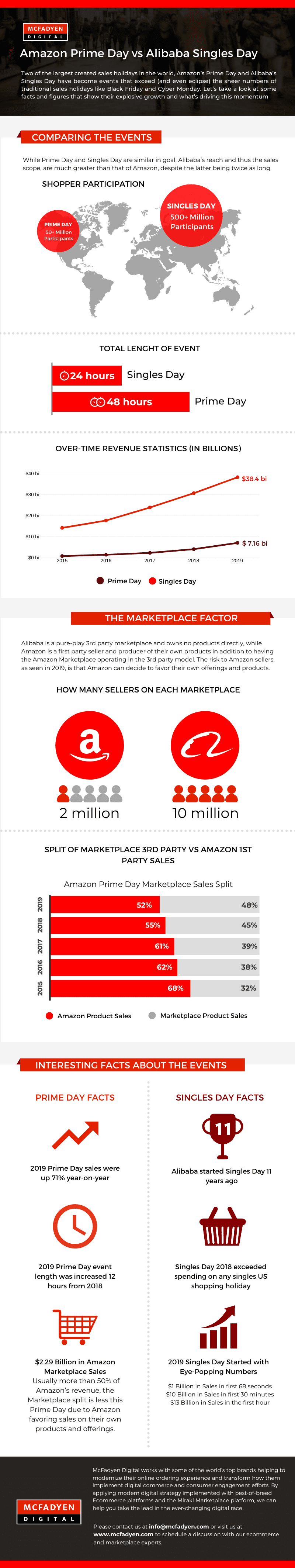

Alibaba’s 2019 Singles Day saw an eye-popping $38.4 Billion in sales during a 24-hour period. That eclipses last year’s record of $30.8 Billion. How hot did this sales event start off? How about $1 Billion in sales in first 68 seconds, $10 Billion in sales in first 30 minutes, and $13 Billion in sales in the first hour. For perspective, it took less than 1/2 hour for Singles Day sales to surpass Amazon’s Prime Day 2019 sales total of $7.16 Billion.

This success is an indicator of positive economic health and high-levels of consumer confidence, but it’s also enormously important validation of the power of the marketplace model of ecommerce. Despite owning the largest ecommerce operation in the world, Alibaba doesn’t own any of the products sold, making them a pure-play marketplace operator with their own ecosystem of more than 10 Million sellers, as opposed to Amazon’s 2 million 3rd party sellers.

How and When Did Singles Day Start?

Many Americans think of Alibaba’s Singles Day event, held every year on November 11th, as their version of Amazon’s Prime Day event, held in July each year, but the truth is that Alibaba got the ball rolling on this whole “created shopping holiday” trend eleven years ago. The notion of Singles Day originated from Nanjing University as a celebration for single people. Eventually spreading to other Universities and then to other parts of China, the original intent of social gatherings was launched into a shopping event by Alibaba as they seized on the day as a time to also celebrate shopping via massive sales.

Today, Alibaba hypes the event with a non-stop live blitz of performances, interviews, speeches, and – of course – live updates of the impressive revenue totals. This year the festivities were headlined by Taylor Swift with appearances and performances by dozens of other celebrities, including Chinese singer G.E.M, Japanese actress Kana Hanazawa, and singer Hua Chenyu.

Showcasing the Power of the Marketplace Model

So Alibaba can create a 24-hour shopping event that generates nearly $643k per second without owning a single product sold, AirBnB can become the largest destination for away-from-home stays without owning a single room, and Uber can become the worlds largest car service without owning a single car. The marketplace model has enabled all of these organizations to become a platform where an entire ecosystem of product and service providers have built their own businesses upon.

Jack Ma, the founder of Alibaba, started the venture in his apartment with 17 friends and students, as he was working as an English teacher. His vision, and partial reason for choosing the name, was the notion of “open sesame”, the magical command that opened otherwise closed doors. According to he man himself, the idea was that “Alibaba opens sesame for small- to medium-sized companies.” Instead of opening another ecommerce store where there would be considerations of product inventory, fulfillment, category expansion concerns, and all of the overhead that comes with running such an operations, Alibaba was designed to be a lean connector of customers and sellers…a digital commerce community bestowing these smaller vendors with a wider audience and providing the audience with endless aisle selection and low prices.

Amazon’s Take on the Alibaba Model

The largest difference between Amazon and Alibaba is that Amazon also offers their own directly-sourced and – in many cases – their own branded items, whereas Alibaba does not directly own products for sale. Amazon’s success both makes them the biggest “frenemy” or “collaboratitioin” a retailer or manufacturer can have and direct proof of the flexibility of the marketplace model. The fact that Amazon is using their marketplace data as a blueprint for which product to white-label demonstrates both the danger of relying heavily on such a third-party sales channel (for those their products will compete with or displace), and the power of the data you have access to as a marketplace operator.

Both Prime Day and Singles Day are great validation points of this model, the true proof is both companies sustained growth of both profits and participating sellers. We now see many other businesses in both the retail and B2B spaces creating innovative and profit scaling concepts with the marketplace model. Electronics giant Best Buy dominated Canada’s ecommerce landscape in the camping gear and baby products categories, Albertsons is now offering an absolutely incredible online assortment of items not carried in stores via the Albertsons Marketplace, and even B2B players like HP Enterprise and Toyota Materials Handling are aboard the marketplace train and providing expanded product and service offerings.

Lessons Learned from Singles Day

Aside from the impressive sales figures and the spectacle of the event, the real lesson here is that when you focus on what makes your customer happy and plan for scale, your business can be a runaway success. Just ask Jack Ma and his 17 colleagues who went from 0 to $38.4 Billion dollars with an invented sales event. Alibaba’s customers are both the buyers of the product and the sellers who offer the product. By catering to both of those audiences with a “rising tide raises all ships” mentality, Alibaba is now a global phenomenon with a valuation of over $500 Billion.

The marketplace model is proven and the good news is that it is now accessible. By partnering with McFadyen Digital and leveraging the power of Mirakl marketplaces, it is possible to add a marketplace to any ecommerce platform or quickly start a new property. Whether you want to rapidly expand product selection, layer on a services component to your offering, or avoid channel conflict while selling directly, please reach out to us at info@mcfadyen.com to learn more about how the marketplace model can add value to your business. To learn more about how to go from 1st party ecommerce to also offering 3rd party items and services, be sure to download your copy of the Marketplace Maturity Model Guide today.

Related Articles

Turn Insight Into Impact.

Start Today.